Current state of real estate

It’s been an incredibly fortunate decade for real estate investors. However, our research suggests that most real estate assets have been speculatively priced above their underlying risk and return drivers. Additionally, given that incomes are fundamentally limited, so too are outsized asset price appreciations.

To address this, Naked Capital employs an operationally focused approach, driving excellent risk-adjusted returns without relying on continued market appreciation. This model allows sophisticated investors to add minimally market correlated returns to their portfolio while still achieving exceptional returns.

A key element of our strategy is to focus on assets too small for institutions and with too sophisticated of a management need for a non-vertically real estate management group.

Our guiding principles

Non-Speculative, Day 1 Cash Flow

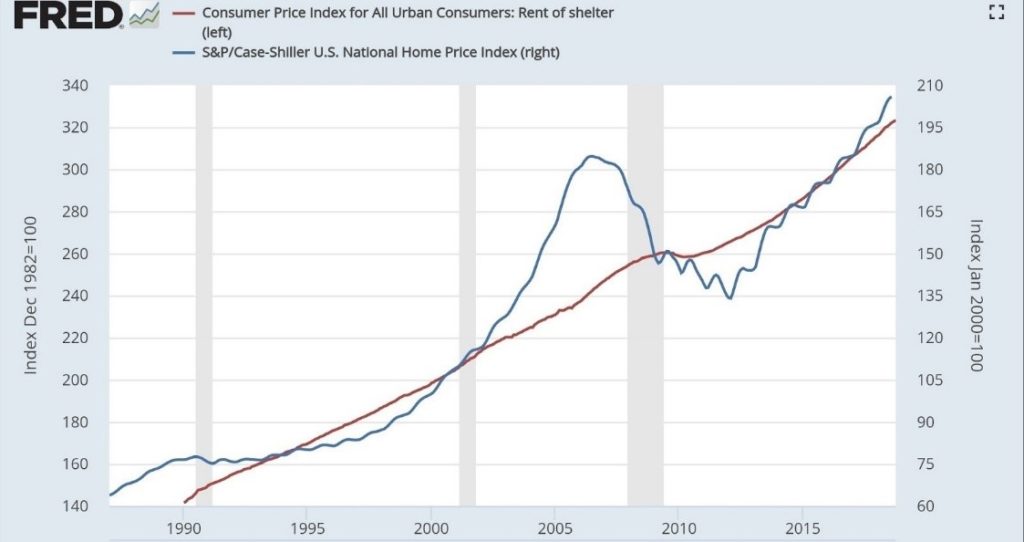

Rental income is demonstrably far more stable than Single Family Homes. During economic downturns, potential single family home buyers elect to continue renting — thereby stabilizing rental rates.

We purchase assets with substantial, sustainable rental income on day 1. This substantial cash flow allows us to underwrite our investments to a market softening vs speculative market appreciation. While the upside to a highly-leveraged and speculative investment may be higher, our goal is to provide consistency and confidence in performance.

Affordability Driven Rental Rates

Although the Multi-family, Value-Add, and Development markets have seen tremendous growth over the past 5 years, most markets are experiencing an oversupply of high-end rental stock relative to demand. Evidence strongly suggests this demand is diminishing. Young professionals are increasingly burdened by student loan costs, stagnant wages, and higher rental prices, while at the same time, the gig economy (think Uber and Amazon) continues to grow further exacerbating the affordability crisis.

We therefore purchase with the following:

- Multi-Family – Our ideal asset is a take-over from an overly speculative Value-Add team, where we will reduce rents initially to increase occupancy and provide value relative to other nearby assets. Once the asset is stabilized, we move forward with the implementation of operational efficiencies.

- Tenant-Owned Manufactured Housing Communities – These are not the “trailer parks” of the 1970s; we buy manufactured housing communities of substantial quality. See below for an owned asset where the MHC owner can pay the mortgage, land rent (to us), and utilities for under $1,000/mo in a market where the average rent is above $1,200/mo and a new home is above $200,000. As affordability issues grow, we can provide the tenant owners with incredible value.

Addressable Operational Inefficiencies

Our goal is to purchase assets where we have a unique operational advantage. This typically comes in the form of a hub-and-spoke operating model with centralized leasing, contracting, legal, and marketing. This model often enables revenues with operating expenses as much as 20–30% less than the original mom-and-pop owner’s cost. We believe that when implemented prudently, this model improves the profitability of the assets, but also increases tenant satisfaction with better servicing to their units; often in situations where the tenants were previously underserved.